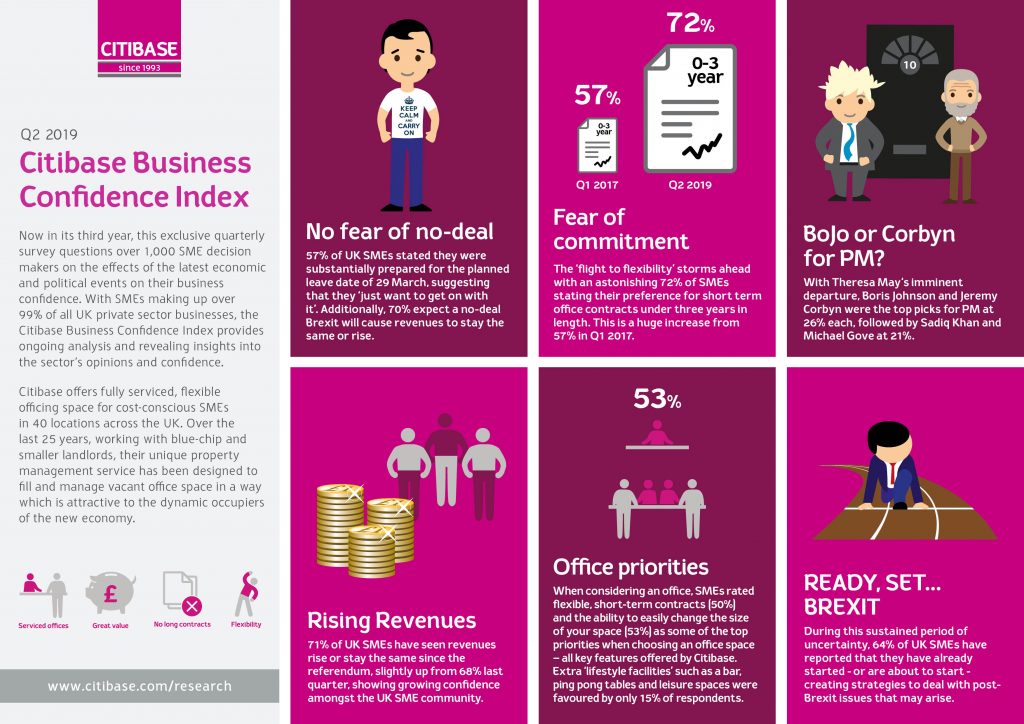

As Brexit uncertainty marches on, the latest Citibase Business Confidence Index reveals that UK SMEs are well equipped for the future with 64% reporting that they have already started – or are about to start – creating strategies to deal with post-Brexit issues, up from 59% last quarter. More interestingly, 57% reported that they were […]

As Brexit uncertainty marches on, the latest Citibase Business Confidence Index reveals that UK SMEs are well equipped for the future with 64% reporting that they have already started – or are about to start – creating strategies to deal with post-Brexit issues, up from 59% last quarter. More interestingly, 57% reported that they were substantially prepared for the planned leave date of 29 March, suggesting UK SMEs just want to get on with running their businesses and would like the Government to ‘just get on with it.’

The exclusive quarterly survey of 1,085 SME decision makers by flexible office champion Citibase, reveals that despite being substantially prepared, 59% still would opt to change their decision on Brexit, restoring the relationship between the UK and the EU to its state before the referendum took place. Interestingly, 70% of UK SMEs expect a no-deal Brexit to cause revenues to stay the same or rise.

Part of the Brexit preparation includes de-risking when it comes to office contracts, with 72% preferring office contract lengths of less than three years, up from 57% at the start of 2017. Additionally, when considering an office, SMEs rated flexible, short-term contracts (50%) and the ability to easily change the size of your space (53%) as some of the top priorities, both increasing in popularity since Q1.

While often grabbing headlines, facilities such as on site bars and cafes ranked poorly (15%) in terms of importance, suggesting that SMEs mostly crave flexibility rather than added extras.

Financially, 71% of UK SMEs have seen revenues rise or stay the same since the referendum, slightly up from 68% last quarter, showing growing confidence amongst the UK SME community. Furthermore, a 38% have found it harder to attract investment or raise funding, which is down 2% from last quarter and down from 50% in Q4.

With Theresa May‘s imminent departure, Boris Johnson and Jeremy Corbyn were the tops picks for PM at 26% each, followed by Sadiq Khan and Michael Gove at 21%. There was also a marked increase in support for Jacob Rees-Mogg from 6% last quarter to 20%. In terms of who SMEs would like to see lead Brexit negotiations, Boris Johnson came out on top at 28%. One respondent even suggested Richard Branson would be best placed to lead negotiations.

44% of UK SMEs think the government did not provide enough support to UK SMES throughout the Brexit uncertainty. Furthermore, only 36% of UK SMEs think Theresa May negotiated a good deal for UK SMEs and 43% believe the latest extension will produce a better deal for UK SMEs.

Steve Jude, Citibase CEO, comments: “This quarter’s results show real confidence and resilience amongst the UK SME community, however they still remain cautious. Therefore it comes as no surprise that office contacts between one and three years are the most desired as they crave flexibility, affordability and agility. Whether we have a deal, a no-deal or a second referendum, UK SMEs just want to get on with running their businesses.”

The exclusive quarterly Citibase Business Confidence Index, now in its third year, reflects the views of 1,085 small businesses across a wide variety of sectors including marketing, PR, financial services, travel and recruitment.

Our latest news and blogs

Need help finding your new office?

Get in touch: